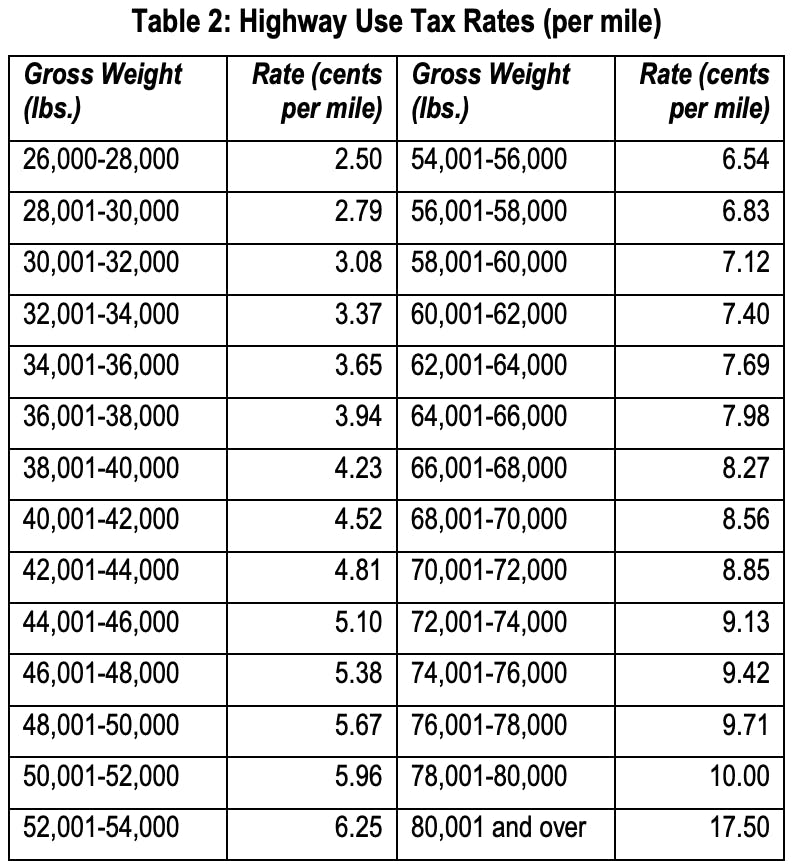

ny highway use tax rates

New York imposes a highway use tax NY HUT or New York Highway Use Tax on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. The tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax.

Nys tax department hut registration unit building 8 room 639 w a harriman campus albany ny 12227.

. The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor vehicle and the. Traveled on New York State public highways and is computed at a rate. The highway use tax HUT is imposed on motor carriers operating motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway.

Rate Sheet for IFTA Packet - 2nd Quarter 2022. New York imposes a Highway Use Tax HUT on any motor carrier using New York highways with a gross vehicle weight over 18000 pounds. The tax rate is based on the weight of the vehicle and the method that you choose to report the tax.

You can find this number on the TMT-7 and TMT-71 Highway Use Tax HUT andor Automotive Fuel Carrier AFC Certificate of Registration. To download publications forms and instructions and to obtain information updates on New York State tax matters visit our Web site wwwtaxnygov. Ny Highway Use Tax Rates.

The New York use tax rate is 4 the same as the regular New York sales tax. What is the highway use tax and how is it calculated. Federal law requires proof that the HVUT tax was paid when you register a vehicle that has a combination or loaded gross vehicle weight of 55000 pounds or more.

Highway Use Tax and Other New York State Taxes for Carriers Publication 538 708 Publication 538 708 1. The tax is based on mileage traveled on New York State public highways and is computed at a rate determined by the weight of the motor vehicle and the method that you. The tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax.

Get your motor carrier authority for only 448. To Web File youre required to report the current certificate number for every vehicle you need to report mileage on. IFTA-1051 922 Not applicable.

Read about the HVUT at the web site of the US Internal Revenue Service or. Trucking Association of New York supports full repeal of New Yorks Highway Use Tax HUT to reduce the tax burden faced by these companies. Highway use tax returns may be filed either by.

These carriers are required to register and obtain a New York HUT certificate and decal. The highway use tax is computed by multiplying the number of miles traveled on New York State public highways excluding toll-paid portions of the New York State Thruway by a tax rate. Including local taxes the New York use tax can be as high as 4875.

When completing your first return for the calendar year you must choose to. Questions about a New York Highway Use Tax Permit or New York IFTA. IFTA Final Use Tax Rate and Rate Code Table 2.

Form MT-903 is. IFTA-1051 622 Not applicable. To register fill out Form TMT-1 or use their online registration system.

Enter the security code displayed above. The Federal Heavy Vehicle Use Tax HVUT is required and administered by the Internal Revenue Service IRS. In general the gross weight method is used to compute your tax and.

For information regarding highway use tax see Tax Bulletin An Introduction to Highway Use Tax TB-HU-40. If you are using a screen reading program select listen to have the number announced. The highway use tax is computed by multiplying the number of miles traveled on New York State public highways excluding toll-paid portions of the New York State Thruway by a tax rate.

Paying all bills will help to avoid accruing larger penalties increasing interest rates and will avoid civil enforcement actions including tax warrants levies income executions and. 18 rows IFTA Final Use Tax Rate and Rate Code Table 2 - 1st Quarter 2022. Includes 300 filing fee BOC-3 and free access to 4 loadboards.

IFTA-105 922 Not applicable. The tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax. You also cant use HUT Web File to add vehicles onto or to cancel.

The following security code is necessary to prevent unauthorized use of this web site. The New York use tax should be paid for items bought tax-free over the internet bought while traveling or transported into New York from a state with a lower sales tax rate. IFTA Final Use Tax Rate and Rate Code Table 2.

A study conducted in. At a rate determined by the weight of the motor vehicle and the method that you choose to report the tax. Tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax.

IFTA Final Use Tax Rate. As a carrier operating certain motor vehicles on the New York State public highways you are subject to the New York State Highway Use Tax Law. For assistance calculating highway use tax see Tax Bulletin How to Determine Your.

Click Edit Rates. New York State Highway Use Tax TMT is imposed on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. You operate a motor vehicle as defined in Tax Law Article 21 in New York State.

For more information see Tax Bulletin Summary of Enforcement Provisions Highway Use Tax TB-HU. New York State imposes a highway use tax HUT on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. If you do not comply with the Highway Use Tax Law you may be subject to civil or criminal penalties.

IFTA-1051 322 Not applicable. Contact DOT Operating Authority with any questions you might have. York based motor carriers may opt to simply not report miles in New York.

Rate Sheet for IFTA Packet - 3rd Quarter 2022. Highway Use Tax and Other New York State Taxes for Carriers Publication 538 812 Publication 538. See Tax Bulletin An Introducti.

I 25 Toll Lane Proposal Between Castle Rock And Monument Might Ease Traffic Jams But It S Inflaming Anti Tax Passions Castle Rock Monument Castle

14948 County Highway 17 Roscoe Ny 12776 Mls 126582 Zillow Roscoe Zillow Party Barn

Ny Highway Use Tax Hut Explained Youtube

Beautiful Facts About New York City New York City Backyard Landscaping Evergreen Vines

Judge Overturns Irs On Artist Tax Deductions Irs Tax Deductions Internal Revenue Service

Ny Hut Permits Ny Hut Sticker J J Keller Permit Service

Ata Ooida Decry Connecticut S New Vehicle Miles Traveled Truck Tax Commercial Carrier Journal

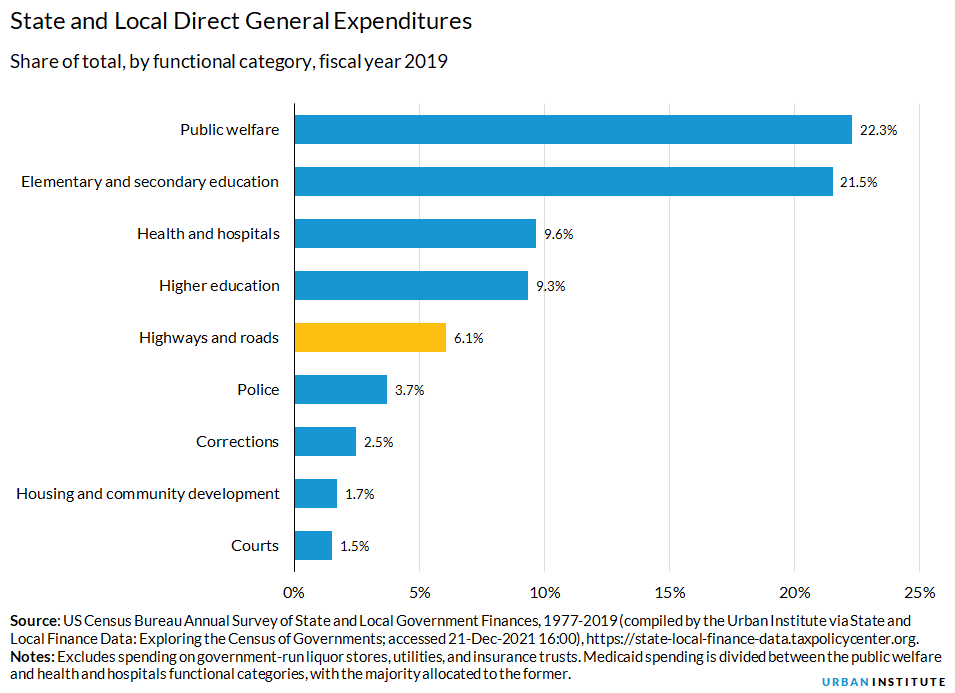

Highway And Road Expenditures Urban Institute

Aed5 3 Billion Of Weeklong Real Estate Transactions In Dubai Urdupoint Estates Real Estate Dubai

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Pacific Coast Highway Santa Monica Lkg S 1968 California Travel Road Trips Pacific Coast Highway Los Angeles History

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Highway And Road Expenditures Urban Institute

Car Moving On A Bridge New York City Stock Footage Bridge Moving Car York Stock Footage New York City Move Car

Start Your Uae Freezone Business With Multiple Activities In One License In 2021 Dubai Activities Business

This Bar Graph Breaks Down Total Federal Income Tax Revenues By The Earnings Percentiles Of The Americans Who Paid Them Federal Income Tax Income Tax Day

10 Best Insurance Broker In New York City Video Insurance Broker Best Insurance Insurance